However in some case the Director General can upon written request allow. Goods and Services Tax in Malaysia can only be collected by GST registered entities.

Do I Need To Register For Gst Goods And Services Tax In Malaysia

Must a Malaysia company collect GST when exporting goods or services out of Malaysia.

. 23 Output tax is the GST that is charged and collected by GST-registered businesses from their customers and is to be paid to IRAS. Registering your Business. The first step to being GST-ready is to register for a GST identification number.

Click Export header hyperlink to transfer the record to excel. Under Goods Services Tax GST system in Malaysia businesses with annual sales of RM500000 or more oblige to be registered under the GST. Please enter the GSTIN numbers of both the buyer and supplier in the section that was provided and complete the.

Related information can be found and downloaded from these. If your business or enterprise has a GST turnover of 75000 or more gross income from all businesses minus GST see Calculating your GST turnover. Clubs Associations Societies Government Agencies Others.

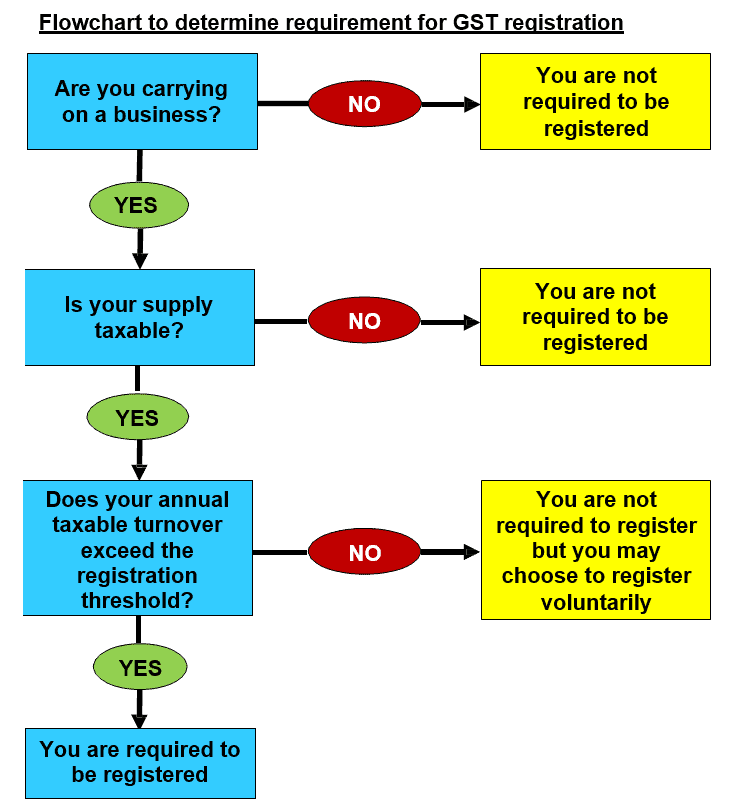

In Malaysia a person who is registered under the Goods and Services Tax Act 201X is known as a registered person. The Malaysia GST requires a GST-registered business which has made an input tax claim but fails to pay his supplier within six months from the date of supply to repay the input tax. Any person who makes a taxable supply for business purposes and the GST exclusive value of the taxable turnover of that supply for a period of 12 months or less exceeds the threshold of RM500000 is required to be registered for GST.

Segala maklumat sedia ada adalah untuk rujukan sahaja. Zero-Rated Supply CompanyFor business that falls in Zero-Rated Supply category the business owner does not have to charge 6 GST even though the companys yearly sales exceed RM500 000. Most organizations use full invoices.

From the suppliers perspective he will be entitled to a relief for bad debt if payment is not received within the same six month period and subject to meeting the. Persons having businesses with annual sales turnover exceeding RM500000 are liable to be registered under GST. The implementation of GST system that has two rates of GST 6 and 0 and provides for the zero-rating of exported goods international services basic food items and many booksAs a broad based tax GST is a consumption tax applied at each stage.

Malaysia replaced its Sales and Service Tax regimes with the Goods and Services Tax GST effective 1 April 2015. List of Taxable Non-taxable Items. Input tax is the GST 2 Whether a business is GST-registered can be verified via the IRAS webpage wwwirasgovsg GST.

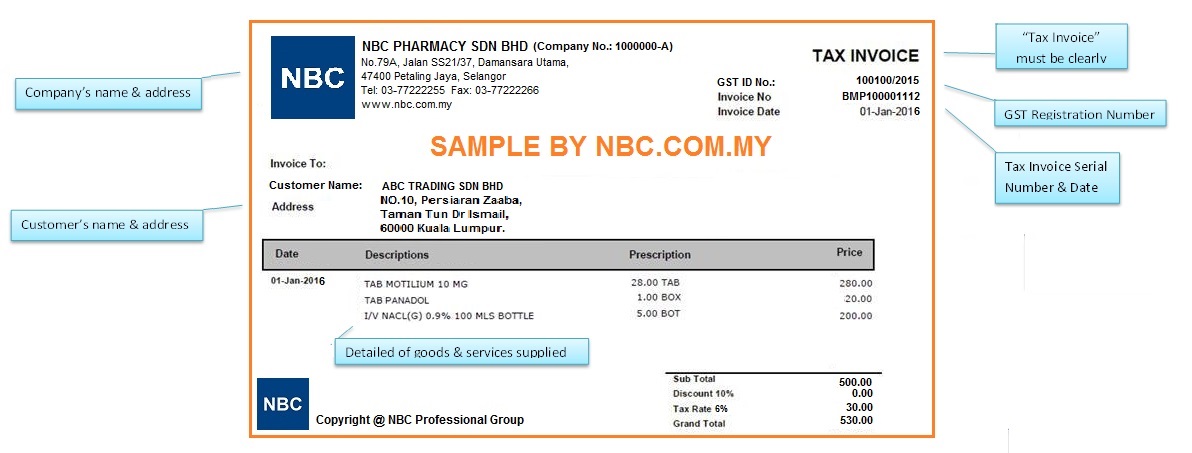

The standard goods and services tax GST in Malaysia is sales and service tax SST of 10. GST Registration Number GST Reg No Description. To avoid confusion on the customer the GST registered person must not issue tax invoice when only making exempt supply or out of scope supply non taxable supply.

A registered person is required to charge output tax on. Click Lookup GST Status. Adalah dimaklumkan bahawa Portal MyGST ini tidak lagi dikemaskini semenjak GST dimansuhkan pada 31 Ogos 2018.

The OVR regime is applicable to Business-to-Consumer B2C supplies of imported digital. Export goods and services are called zero-rated supplies and GST is not applicable. To ensure a smooth implementation of GST businesses are encouraged to submit their application for early registration.

Business under GST group divisional registration Sole proprietorships Reference number for GST matters M91234567X MR2345678A. The two reduced SST rates are 6 and 5. There you will find information about the GST process.

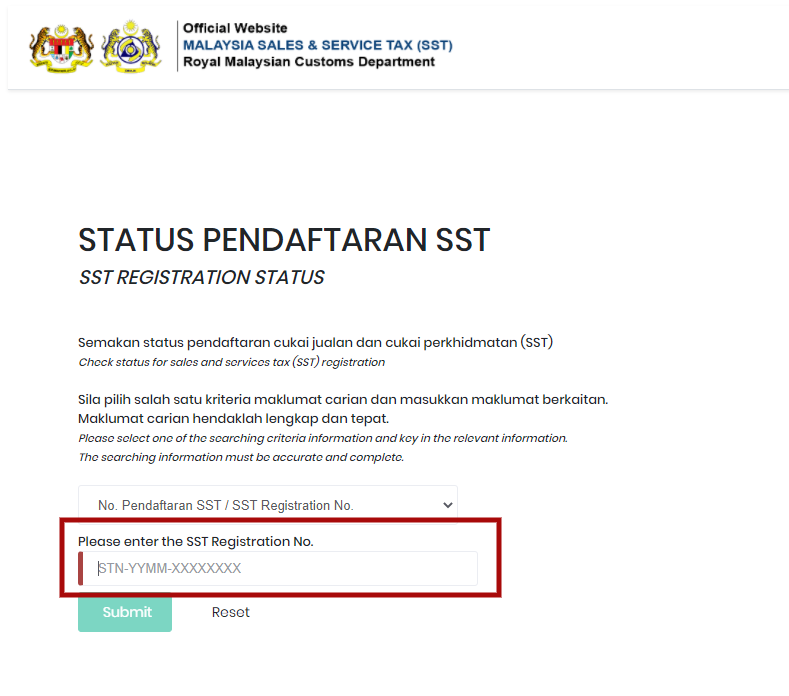

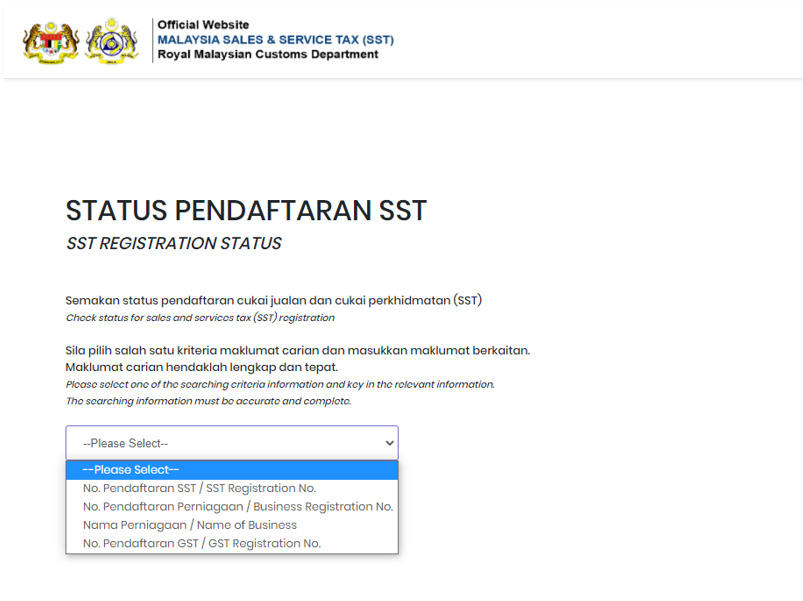

You are required to check GST Registration Status for A Business in Malaysia to ensure the tax invoice is valid for input tax claiming. RMCD is ready to accept application for registration from 1 June 2014. It applies to most goods and services.

However to level the GST treatment between local and overseas suppliers that provide services to consumers overseas businesses will have to charge GST on services exported to Singapore from 1 January 2020 via the Overseas Vendor Registration OVR regime. List of search results will be. Limited Liability Partnerships LLP T08LL1234A.

You need to check whether you are required to register or whether you want to register voluntarily. Portal akses bagi pembayar cukai. However once registered the businesses must.

GST invoice format Select either Full invoice or Simplified invoice as the printing format for GST invoices. Sehubungan dengan itu sebarang pertanyaan dan maklumat lanjut berkaitan GST sila hubungi Pusat Panggilan Kastam 1-300-888-500 atau emailkan ke ccccustomsgovmy. The first reduced SST rate 6 applies to restaurants hotels and accommodation car hire rental and repair domestic flights insurance credit cards legal and accounting business consulting electricity.

Select any search Fill in related information. As announced by the Government GST will be implemented on 1 April 2015. In Step 1 visit GST Portal.

However business with taxable turnover of RM500000 and below even though not required to be registered may. If your business annual sales do not exceed this amount you are not required to register for GST. The threshold starting from 1 June 2013 and the business is liable to be registered for GST within twenty eight days from this date ie.

If a Malaysia company is not GST registered can it collect GST tax. Use self-billed invoice Set this option to Yes if you must issue self-billed invoices in some circumstances. Semakan Syarikat Berdaftar GST Berdasarkan Pendaftaran Syarikat Nama Syarikat atau Nombor GST Check For GST Registered Company By Company Registration Company name or GST Number Senarai Barangan Bercukai Tidak Bercukai.

However the company will still need to register with Customs Department in order to claim back GST paid on the purchases expenses. Such businesses can apply for voluntary registration.

Step By Step Guide To Apply For Gst Registration

Malaysia Sst Sales And Service Tax A Complete Guide

Malaysia Sst Sales And Service Tax A Complete Guide

Gst Registration At Rs 899 Gst Consultancy Services Gst Taxation Consultancy Services Gst Taxation Consultancy Gst Consulting Services Gst Registration Services New Items Rahyan Multi Services Kanpur Id 20559298562

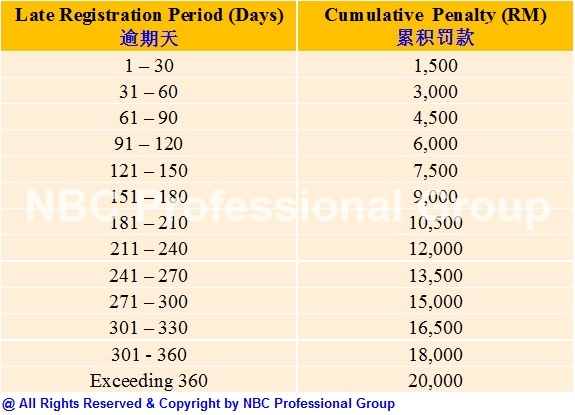

Malaysia Goods And Services Tax Gst Penalties Goods Services Tax Gst Malaysia Nbc Group

Malaysia Goods And Services Tax Gst Penalties Goods Services Tax Gst Malaysia Nbc Group

Gst Registration In Gujarat Process Required Documents Enterslice

Everything About Gst Registration Of An Llp Ebizfiling

Malaysia Goods And Services Tax Gst Penalties Goods Services Tax Gst Malaysia Nbc Group

Everything About Gst Registration Of A Private Limited Company Ebizfiling

Do I Need To Register For Gst Goods And Services Tax In Malaysia

How To Check Sst Registration Status For A Business In Malaysia

Gst Registration In Uttarakhand Complete Process Enterslice

What Is Tax Invoice How To Issue Tax Invoice Goods Services Tax Gst Malaysia Nbc Group

What Is Tax Invoice How To Issue Tax Invoice Goods Services Tax Gst Malaysia Nbc Group

Uparrow Malaysian Gst Enhancement 1st Phase Implementation Home Gst Malaysian Gst Enhancement 1st Phase Implementation September 24 2014 Mohd Imran Gst No Comments Contents Hide 1 Introduction 2 Activating Gst Functions 3

Step By Step Guide To Apply For Gst Registration

Step By Step Guide To Apply For Gst Registration